There’s never a good time for bad news, be it the energy shock, China’s economic slowdown, big geopolitical tremors or central banks falling behind the inflation curve. In 2022, markets have had to adapt to – and navigate around – these disruptions and myriad others.

Investors face daunting visibility challenges as virtually everything that they thought they knew about the road ahead goes awry all at once. These visibility challenges make it hard to assess the true health of balance sheets – and to know which companies’ shares to buy or sell.

This disorientation is muddying once-sacrosanct relationships between bond yields, currencies, stock valuations and the health of bank balance sheets.

Where to turn? Euromoney Market Leaders rankings are here to fill the intelligence void across Asia. This new accreditation programme, unveiled this year, is a comprehensive and dynamic ranking of banking and finance names across a host of sectors and key themes – all presented at a country level.

The ranking process is a meticulous and rigorous one, drawing on Euromoney’s 25 years of evaluating institutions around the world. Thanks to an ever-expanding universe of data, surveys and industry awards evaluated across the different brands within the Euromoney group, including sister publications Asiamoney and Euromoney, the team is singularly positioned to offer reality checks on Asia and its prospects.

Euromoney Market Leaders’ methodology is rigorous. It involves eight categories: investment banking; corporate banking; SME banking; Islamic finance; environmental, social and governance; digital solutions; corporate social responsibility; and diversity and inclusion.

Rankings are based on a range of inputs including relevant numerical data and targets, products and projects, as well as initiatives, transactions and specific policies. Case studies and accreditation highlights such as awards, rankings and ratings are also factored in.

The decision-making and ranking for Euromoney Market Leaders are done entirely at the discretion of the research team with no editorial involvement. Banks are ranked into three categories – market leaders, highly regarded and notable – based on their performance during the review period of April 1, 2021, to March 31, 2022.

Concerns

This year’s rankings process showed global investors’ keen focus on the regulatory chaos plaguing China’s economy. Of course, slowing top-line growth in Asia’s biggest economy is a pressing concern. This includes uncertainty about the direction of ‘zero Covid’ lockdowns and the stability of China’s debt-riddled property market.

What came through loud and clear were investors’ concerns about the state of play for reforms to China’s IPO process, the government’s crackdown on big tech, progress toward digitalization and opening the country up to global investment banks which are keen to tap mainland growth.

The most intriguing insights, though, involve how closely Asian markets are tied to the zigs and zags in China’s economic and financial trajectory.

Take Hong Kong, a place that arguably has more riding on president Xi Jinping’s ability to build a vibrant and innovative China than any other. With Chinese growth dipping to just 0.4% in the April-to-June quarter, Hong Kong’s economy seems to be on a path to contract for the third time since 2019. The government says gross domestic product might contract 0.5% in 2022.

The turmoil in Greater China, combined with the global market volatility, has taken a toll on Hong Kong’s usually buoyant capital markets, impacting bond and IPO volumes this year. But investment banks are persevering.

Market leaders

In the Euromoney Market Leaders rankings for Hong Kong investment banking, Citi, Credit Suisse, Goldman Sachs, JPMorgan, Morgan Stanley and UBS have been named market leaders.

All these firms showed strength and resilience during the review period. Morgan Stanley’s dominance in capital markets and mergers and acquisitions, for instance, proved hard to beat. It played a key role in listing Hong Kong’s first special purpose acquisition company, while Goldman Sachs stands out for its role in the city’s biggest IPOs.

BOC International, China Construction Bank International, HSBC, Haitong International and Huatai International Securities walk away with the highly regarded investment bank titles, while DBS finds a spot among the most notable investment banking houses in Hong Kong.

In corporate banking in the city, the market leaders are Citi, DBS, HSBC and Standard Chartered, while Bank of East Asia and Hang Seng Bank are ranked among the highly regarded institutions. Citi, for example, boasts a number of best-in-class businesses, such as unrivalled capabilities in foreign exchange and highly competitive offerings in structured finance and syndicated loans.

DBS offers a multi-currency savings account product with highly personalized dashboards for business accounts. And HSBC’s welcome offers for new corporate account openings are hard to beat.

In the ESG market, a white-hot segment in Hong Kong, Bank of China (Hong Kong), HSBC and Standard Chartered lead the market, with Bank of East Asia, DBS, Haitong International Securities and Hang Seng Bank earning nods in Euromoney Market Leaders’ highly regarded category.

BOC HK, for example, leads because it prioritizes ESG in all business endeavours, both for long-standing relationships and new ones. It is also uniquely proactive in supporting local sustainability initiatives. HSBC is renowned for going the extra mile to partner with non-government organizations, and also actively engages with youth groups.

For digital solutions in Hong Kong, BOC HK, DBS and HSBC form the market leaders. Among banks highly regarded for their digital and app-savviness are Bank of East Asia, Citi and Hang Seng. Of the leaders, HSBC gets recognition for innovative, extensive and free digital services across all its businesses.

Euromoney Market Leaders offers badly needed guidance at a time of unprecedented uncertainty for the world’s most dynamic region

HSBC also walks away with Hong Kong’s top ranking for diversity and inclusion, in part for how it marries these initiatives together with its digital apps. They are key to HSBC’s financial products aimed at people with no fixed address, including refugees and ethnic minorities.

Taiwan stands out as banks try to manage credit risks, maximize wealth management returns and not lose market share to fintech startups. They are focusing on all this while navigating its proxy-economy status as China and the US trade diplomatic barbs.

The US Federal Reserve’s interest rate hikes could also boost Taiwanese bond yields, while reducing demand for its all-important semiconductor industry.

The island’s market leaders among investment banks are Citi, CTBC Bank, Goldman Sachs and Morgan Stanley, while Credit Suisse and UBS are the highly regarded firms.

E.Sun Commercial Bank leads the corporate and SME sector, while DBS earns highly regarded honours and Taipei Fubon Bank gets the notable nod for work in the corporate banking industry.

Among international investment banks, Goldman’s franchise gets credit even from rivals, thanks to the extremely wide range of transactions it completes, the impressive size of these deals, and its ability to multitask and handle numerous mandates simultaneously. CTBC, meanwhile, led some 129 deals during the review period for Euromoney Market Leaders.

Leading the pack in digital solutions are Bank SinoPac, CTBC Bank and Taishin International Bank. CTBC consistently tops customer experiences, while its prowess in collecting user feedback and embrace of blockchain technology are keeping rivals on their toes.

Bank SinoPac’s Dawho digital account integrates deposits, credit cards, investments and trading into one product. Its app for SMEs is upending the local business scene.

When it comes to digital solutions, Cathay United Bank, E.Sun Commercial Bank and Yuanta Bank are making serious inroads too, earning the highly regarded status by the Euromoney Market Leaders team. Hua Nan Bank, Taipei Fubon Bank and Standard Chartered are among the notable banks.

ESG leaders are DBS and E.Sun, while CTBC tops the CSR category. Champions for diversity and inclusion are Bank SinoPac and Standard Chartered, while Taishin International Bank is notable for its work in this area.

A weathervane

Singapore’s status in Asia is much discussed these days. One reason: its large, open economy is a reliable weathervane for the direction of global demand.

But nothing good comes from the build-up of container ships lying idle off the city-state’s shores. Signs that Singapore might grow as little as 3% this year are ominous indeed.

However, intelligence gleaned from the Euromoney Market Leaders’ rankings hints at Singapore’s fast-growing role as a safe haven not just for wealthy southeast Asians but also for wealthy Chinese. It’s the vanguard, too, of Asian markets wading into digital assets, including funds built around crypto-currencies.

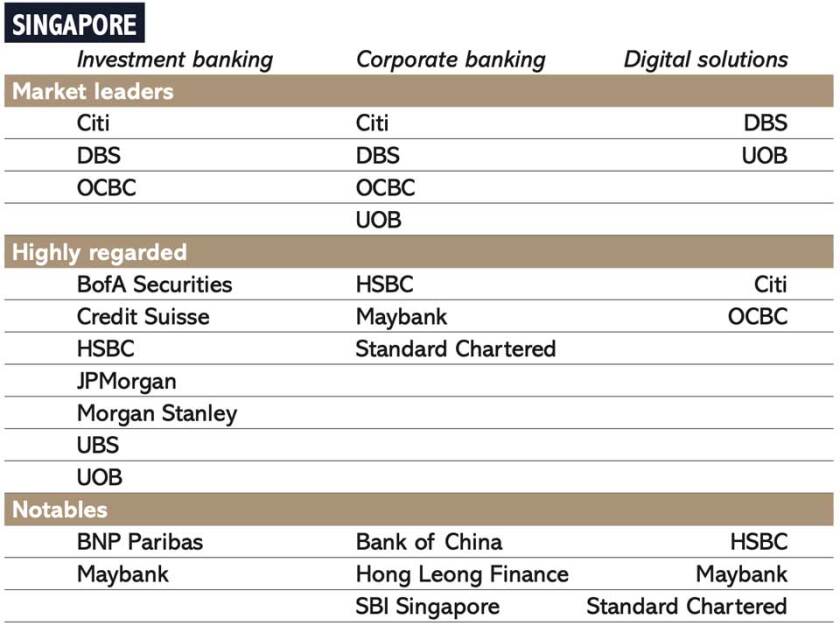

The top spots among investment banks vying for those Asian wealth flows and the deal mandates that come with them are held by Citi, DBS and Oversea-Chinese Banking Corp, the market leaders.

Coming in strong, too, are Bank of America, Credit Suisse, HSBC, JPMorgan, Morgan Stanley, UBS and UOB, which have been categorized as highly regarded investment banks.

Corporate banking market leaders are Citi, DBS, OCBC and UOB, with HSBC, Maybank and Standard Chartered all climbing the charts behind them as highly regarded houses.

Hong Leong Finance is raising its game, too, earning a notable shout-out in the corporate banking rankings, alongside Bank of China and SBI Singapore.

Singapore is also going digital in a hurry, as befits an economy with ambitions to be the headquarters of choice for fintech entrepreneurs. This year’s market leaders for digital solutions are DBS and UOB, while Citi and OCBC make it into the highly regarded rankings, and HSBC, Maybank and Standard Chartered are ranked among the notables.

Few Asian economies have embraced ESG principles with such enthusiasm and integrity. Market leaders in ESG are DBS and HSBC, followed by Citi, Maybank, Standard Chartered and UOB.

Insights

All this is but a sprinkling of timely insights unearthed by the Euromoney Market Leaders team across the region. Specific rankings are also provided for Cambodia, China, Indonesia, Malaysia, the Philippines, Thailand, Vietnam, Bangladesh, India, Pakistan, Sri Lanka and Uzbekistan, all of which are available on the Euromoney Market Leaders website.

What makes the Euromoney Market Leaders initiative all the more urgent is the ways in which Asia’s corporate systems are remaking themselves in real time. Discerning the nature and quality of such shifts requires an equally dynamic and nimble means of assessment. Euromoney Market Leaders takes great care to evaluate evidence of innovation, creativity and market impact based on quantitative and verifiable metrics.

Banks are then scored through the lens of pre-defined and criteria-specific goal posts for each category. They are scored on a scale of 0 to 10 for each criterion and ranked accordingly from economy to economy.

The aim is to offer badly needed guidance at a time of unprecedented uncertainty for the world’s most dynamic region – all while helping Asia with its visibility troubles, one ranking at a time.